Business - from nerd to entrepreneur (-nerd)

The beginnings

In 1995, with the

support of my parents, I opened a specialist shop for IT and

computers in Bingen am Rhein, Germany, at the age of 17. At the same

time, it was the first internet café within a radius of 50

kilometres:"Computerman" was born. In the shop I sold hardware and

software, in Bingen and the surrounding area I also offered an

on-site service around computers. Although I was technically almost

unbeatable, I had no commercial experience. While there was money to

be made with the on-site IT service, the shop itself was a big

miscalculation and a loss business, which neither I nor my parents

could have afforded in the long run. After only one year I closed

the shop again. The computer shop became my first GmbH, the

"Computerman PC-Services GmbH". I received the necessary start-up

capital from a kindly gentleman, who had been a client of mine with

his brokerage company, and now invested in me and the development of

the company.

In 1995, with the

support of my parents, I opened a specialist shop for IT and

computers in Bingen am Rhein, Germany, at the age of 17. At the same

time, it was the first internet café within a radius of 50

kilometres:"Computerman" was born. In the shop I sold hardware and

software, in Bingen and the surrounding area I also offered an

on-site service around computers. Although I was technically almost

unbeatable, I had no commercial experience. While there was money to

be made with the on-site IT service, the shop itself was a big

miscalculation and a loss business, which neither I nor my parents

could have afforded in the long run. After only one year I closed

the shop again. The computer shop became my first GmbH, the

"Computerman PC-Services GmbH". I received the necessary start-up

capital from a kindly gentleman, who had been a client of mine with

his brokerage company, and now invested in me and the development of

the company.

Initially, the main source of income continued to be IT services for the regional economy. At the same time, I designed a software for corporate use and managed the development until the completion of a marketable product. Chatjet ", a chat system for internal corporate communications and web-based live customer support, was first introduced at the Systems 1999 computer trade fair and achieved a breakthrough around the year 2000 despite the collapse of the New Economy (" Dot Com bubble ").

During this time I gained valuable experience as a managing director. The development and distribution of "Chatjet" to customers such as Sal. Oppenheim, Deutsche Post AG or the State of Baden-Württemberg were not only useful for my future activities in terms of experience in project management and sales.

With Computerman's services and the Chatjet product, I didn't get

rich, but the company was profitable enough to feed me for many

years, as well as a small but growing number of employees. At the

same time, this gave me the opportunity to learn with Trial &

Error or Learning by Doing what other people might have preferred to

study. Whether accounting, writing business plans, accounting or

marketing - there were things to discover, understand and learn

everywhere.

The idea of Viprinet

In 2005 I was faced with a

problem - the developed chat server system Chatjet continued to sell

well. However, customers now included such big names as Deutsche

Post, who held staff conferences with them. The permanent

availability of the chat services operated by me, as well as the

accessibility of the office network of Computerman from the Internet

was therefore of crucial importance.

In 2005 I was faced with a

problem - the developed chat server system Chatjet continued to sell

well. However, customers now included such big names as Deutsche

Post, who held staff conferences with them. The permanent

availability of the chat services operated by me, as well as the

accessibility of the office network of Computerman from the Internet

was therefore of crucial importance.

On the other hand, there was the company's internet connection: For a 2 MBit/s dedicated line with backup service I paid more than 2,000 Euro per month, which made it the largest running cost position. And despite all the provider's availability guarantees, the line was permanently down. So much money for so little performance? It couldn't have been.

I had the idea to have several of the DSL connections, which had become available in Bingen for the first time in the meantime, installed. Over each of these lines I wanted to build a VPN tunnel to my server located in a data center in Frankfurt, in order to use the capacity of these lines bundled together. I wanted to route the required fixed public IP addresses to my office independently of the line provider through the VPN. All in all, I wanted to become completely independent of line providers. But there was one problem: There were no routers that could have bundled several different lines as VPNs.

The idea of using several consumer

broadband lines bundled together to save costs seemed obvious to me.

If the idea was simple, but there were no products, there had to be

a technical obstacle. And so it was: Even with only minimal

differences in the running times of data packets on the individual

lines, the packets would arrive incorrectly sorted at the receiver

if these lines were used in a bundled form. However, such a

mis-sorting would incorrectly interpret TCP/IP as packet loss in the

Internet protocol, which would cause the data transfer rate to

collapse. The Internet was simply not designed to allow the IP

packets of a single data connection to take different paths at the

same time.

The idea of using several consumer

broadband lines bundled together to save costs seemed obvious to me.

If the idea was simple, but there were no products, there had to be

a technical obstacle. And so it was: Even with only minimal

differences in the running times of data packets on the individual

lines, the packets would arrive incorrectly sorted at the receiver

if these lines were used in a bundled form. However, such a

mis-sorting would incorrectly interpret TCP/IP as packet loss in the

Internet protocol, which would cause the data transfer rate to

collapse. The Internet was simply not designed to allow the IP

packets of a single data connection to take different paths at the

same time.

So I set about solving this technical problem. I realized that previous implementations of the TCP/IP protocol could not be extended for this purpose, all attempts in this direction by other vendors had failed. So I developed a new implementation that for the first time made VPN bundling possible. The development of an own TCP/IP stack turned out to be quite a mammoth task.

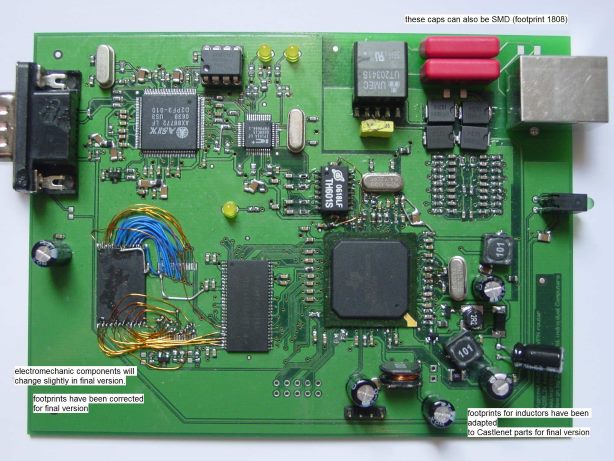

But by the end of 2005, I had already completed a corresponding proof-of-concept. I now had a software router that was able to use several different lines bundled for a VPN. In combination with a commercially available PC, a Linux operating system and a stack of network cards and modems, I had a somewhat crafted but ready-to-use solution. I terminated the leased line and replaced it with several bundled DSL connections. I had now reduced my ongoing connection costs by 85% and at the same time multiplied the bandwidth available to my company.Actually, I only wanted to solve one problem for myself. However, it quickly became clear to me that Computerman would not be the only company that would welcome such savings and improvements in Internet connectivity. As Internet connections became increasingly cheaper for private customers, while dedicated lines remained expensive for companies, there was a clear sales market here.

Foundation of Viprinet

As a software solution I could hardly sell my proof of concept -

people would expect a hardware router. In addition, my handicraft

solution looked very chaotic - six ADSL modems hanging on a computer

caused a lot of cable clutter. So I wanted to create a router with

the modems already integrated, so that you only need one single

device to bundle several lines.

As a software solution I could hardly sell my proof of concept -

people would expect a hardware router. In addition, my handicraft

solution looked very chaotic - six ADSL modems hanging on a computer

caused a lot of cable clutter. So I wanted to create a router with

the modems already integrated, so that you only need one single

device to bundle several lines.

Together with the development team of Computerman GmbH and other

friends from the nerd community (demoscene) I started to develop a

suitable device. At the same time, I founded Viprinet GmbH - again

together with members of the computer art community - which was to

bring this development to market later on. All the shareholders brought a little money with them. As a

thank-you for his support of me, my sponsor and co-partner also

received some shares in Computerman GmbH. The name Viprinet is

actually made up of "Virtual Private Network".

All the shareholders brought a little money with them. As a

thank-you for his support of me, my sponsor and co-partner also

received some shares in Computerman GmbH. The name Viprinet is

actually made up of "Virtual Private Network".

We showed the first functional prototype at CeBIT 2007, won an innovation prize and the television reported. We encountered some buying interest. It was indeed good and important to receive this confirmation. However, our products were far from being able to be produced or even sold, which is why interest could not turn into sales at first.

Market introduction and financing problems

Our minimum start-up capital was soon used up. When our products were then about to be launched on the market in 2008, it became clear that the capital requirements predicted in the business plan could not be met without further ado - the high complexity of the subject matter was not yet matched by measurable sales successes for the products, and potential investors considered the plan to set up a router manufacturer in Germany to be too risky. Our house bank assumed at that time that we would build washing machines.

So an investor had to be found.

A private investor from outside the sector was recruited via

contacts of an existing shareholder, Mr. Hans-Jürgen S. His GERES

Group invested in wind farms. The then Managing Director Hans-Jürgen

S. was enthusiastic about the company and invested funds from his

participation in GERES. This was the first time that the production

of the first product series was secured. At CeBIT 2009, we showed

for the first time how our products could also be used in vehicles:

The Gigabus offered live video streaming at every seat and

super-fast Internet throughout the bus. The trade fair presentation

turned out to be a complete success and the first sales partners

could be won.

So an investor had to be found.

A private investor from outside the sector was recruited via

contacts of an existing shareholder, Mr. Hans-Jürgen S. His GERES

Group invested in wind farms. The then Managing Director Hans-Jürgen

S. was enthusiastic about the company and invested funds from his

participation in GERES. This was the first time that the production

of the first product series was secured. At CeBIT 2009, we showed

for the first time how our products could also be used in vehicles:

The Gigabus offered live video streaming at every seat and

super-fast Internet throughout the bus. The trade fair presentation

turned out to be a complete success and the first sales partners

could be won.

Since no further investors could be found even during the current

market launch, the founding partners had to help out together with

GERES time and again from their own funds with loans and capital

increases, so that all participants reached their economic limits.

In the course of this, the founders' shares continued to dilute, and

when GERES took over the shares of a retiring shareholder (the real

estate agent mentioned above), GERES finally held 62% of the shares

in Viprinet GmbH. The founders were therefore no longer majority

shareholders but minority shareholders in their own company.

However, since I had secured my rights in the articles of

association (all decisions required my consent, there were strong

rights for minority shareholders), I felt secure. A mistake.

Disputes among shareholders

Subsequently, the investment made via GERES was now managed by Mr. W.. Mr. W. didn't suit us, and we didn't fit him. Mr. W. did not agree with Viprinet GmbH's strategic orientation, which at this point in time was actually already experiencing quite rapid growth, and greater risks should be taken in favor of a short-term exit through the sale of an investment. The founders got the impression that Mr. W. simply urgently needed money - against the backdrop of the crisis in the wind power industry at that time, this seems to be conclusive. The founders, including myself, had no intention of selling the company.

Despite the disagreement among the shareholders, Viprinet itself

continued to develop very well. In 2011, the company even posted

profits for the first time in spite of everything.

Despite the disagreement among the shareholders, Viprinet itself

continued to develop very well. In 2011, the company even posted

profits for the first time in spite of everything.

However, as a result of the disagreements, the company has been cut off from any outside financing possibilities since 2010. In order to be able to grow further, it would have required the further construction of a component warehouse. This is especially true because the availability of electronic components was very variable at the time due to various disasters in Asia. In 2011, monthly sales of up to 350,000 euros and a warehouse with a purchase value of more than 500,000 euros combined with only a current account credit of 233,000 euros from the house bank. We therefore had to serve our warehouse almost exclusively from our cash flow.

The conflict between the shareholders could not be resolved even after weeks of negotiations, and GERES was not prepared to sell back its shares to the founders, even for the highest possible valuations. However, GERES did not like to buy their shares from the founders. Incidentally, a bizarre love-hate affair was also evident: Mr. W. wanted to snatch control of the company from me, but was convinced that without me, the company was worthless. This attitude that one would like to keep my brain, but remove my personality, I have encountered several times in my life. It is comprehensible to me, but I would have liked to have seen the biological impossibility of this wish more consciously with my fellow human beings.So the situation was completely stalled. Corporate financing was impossible. GERES' efforts to take control of the company led to an increasing blockade and, in some cases, to a complete shutdown of the company. They tried to dismiss me as managing director with interim injunctions (which even succeeded for a short time), which would have left the company without leadership. An attempt was made to appoint an "emergency manager", who Viprinet employees were then exposed as con artists with false resumes and wrongly carried doctorate titles and had them removed by the courts. The whole thing went so far that GERES seriously tried to storm and occupy the company building. When the employees prevented this from happening (doors were barricaded, a security service was assigned and the building owner banned all GERES employees from using the building), the attacks became more and more crazy. In the absence of the co-partners, GERES wrote down a "shareholders' resolution" which authorised them to terminate our lease agreement, making the company "homeless".

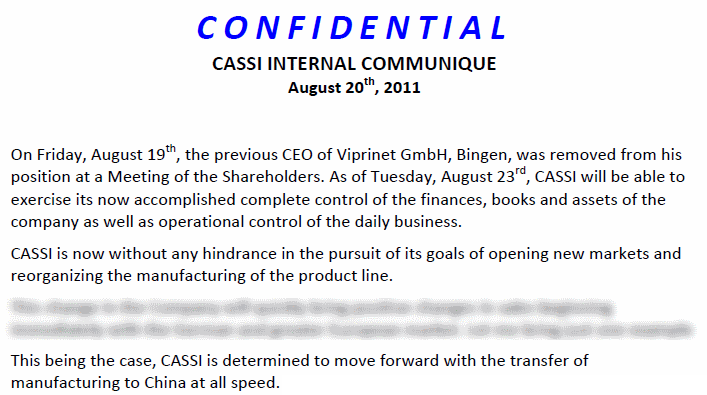

The founders now had the impression that it was no longer about taking control of the company, but about its operational destruction. In the meantime Viprinet had been granted the patents I applied for in 2007 - which was really great news for the shareholders. In connection with the plans written down by CASSI LLC (and thus GERES employees) to relocate production to China and/or to sell the company, it can be assumed that there was now hope that at least these patents could be turned into money.

In the end, the conditions were completely unsustainable and caused severe traumas for the parties involved. After the unsuccessful attempt to storm the company, I only dared to go out with bodyguards. I had landed in a completely absurd horror scenario. I was desperately looking for a way out where I would not have had to give up the company - and the friends and family that I had founded there.

Viprinet insolvency

Despite this madness, we were

able to launch new products at CeBIT 2012. After that was done, I

pulled the rip cord in March 2012 and filed for bankruptcy at the

district court of Bingen. The company was placed under the

provisional administration of an insolvency administrator. The

company was thus finally deprived of control by the warring

shareholders. I myself was still under heavy fire, but the company

and its employees no longer had to suffer from the company's

shareholders. However, I had to live with the fact that the capital

I had invested, including the guarantees I had given to the company,

was no longer there.

Despite this madness, we were

able to launch new products at CeBIT 2012. After that was done, I

pulled the rip cord in March 2012 and filed for bankruptcy at the

district court of Bingen. The company was placed under the

provisional administration of an insolvency administrator. The

company was thus finally deprived of control by the warring

shareholders. I myself was still under heavy fire, but the company

and its employees no longer had to suffer from the company's

shareholders. However, I had to live with the fact that the capital

I had invested, including the guarantees I had given to the company,

was no longer there.

Since the company was focused on me as a central figure in its

entire structure, the insolvency administrator was quickly aware

that a continuation of Viprinet GmbH would only be possible under my

leadership. He realized that when I left the company, i. e. when I

sold it to a third party, the company would lose most of its value

because a large part of the know-how was in my brain. Nevertheless,

it was not possible to persuade GERES to sell its shareholding, even

if the insolvency administrator acted as mediator.

In close cooperation with me, the insolvency administrator almost

seamlessly continued the company - there was no loss of supplier

relationships or employees. Even the supplier loans granted to

Viprinet's partners via a factoring company could be continued

without interruption.

The insolvency proceedings were seen by most of the parties involved

as an opportunity to enable the company to continue its successful

future under a new shareholder structure. If the partners could not

agree on a separation, they would now be forced to be separated.

The "forced management buy-out"

The insolvency administrator

considered it the most sensible thing to sell the company in a

public sale process and to advertise it. The creditors' meeting of

Viprinet GmbH should then decide which of the bids submitted would

be accepted. The founders decided to offer the company, as did GERES

and some third parties. The highest and best bid came from my Kissel

Ventures GmbH and my colleagues. It was designed in such a way that

the money should be enough to pay all liabilities - no one else

except the perpetrators themselves should have to suffer from the

insolvency.

The insolvency administrator

considered it the most sensible thing to sell the company in a

public sale process and to advertise it. The creditors' meeting of

Viprinet GmbH should then decide which of the bids submitted would

be accepted. The founders decided to offer the company, as did GERES

and some third parties. The highest and best bid came from my Kissel

Ventures GmbH and my colleagues. It was designed in such a way that

the money should be enough to pay all liabilities - no one else

except the perpetrators themselves should have to suffer from the

insolvency.

While GERES - cautiously put it this way - didn't exactly spark a

storm of enthusiasm in the courtroom filled with employees, partners

and suppliers, my offer received full support there. Whether it was

the employment office, employees, suppliers or banks - everyone

spoke out clearly in favour of my plan. In the end, the vote was

taken and the result was overwhelmingly clear. Cheers were on the

rise, and Viprinet celebrated extensively. There were GERES canning,

GERES dart and a huge GERES piñata.

While GERES - cautiously put it this way - didn't exactly spark a

storm of enthusiasm in the courtroom filled with employees, partners

and suppliers, my offer received full support there. Whether it was

the employment office, employees, suppliers or banks - everyone

spoke out clearly in favour of my plan. In the end, the vote was

taken and the result was overwhelmingly clear. Cheers were on the

rise, and Viprinet celebrated extensively. There were GERES canning,

GERES dart and a huge GERES piñata.

Viprinet restarts as Viprinet Europe GmbH

Due to the insolvency proceedings of Viprinet GmbH and the associated uncertainty in the market, there was a considerable backlog of project-related orders - many customers had waited for an order until a secured successor company to Viprinet GmbH was ready. The new Viprinet Europe GmbH was therefore able to process a large number of orders directly after taking over its business activities. Market confidence was quickly restored. After all, nothing had changed operationally except for the addition of "Europe" to the GmbH name.

GERES-Verwaltungsgesellschaft files insolvency petition

The mission of getting the insolvency administrator to return the money paid to him to the creditors was much more difficult than expected. It certainly did not help that Mr W. and GERES did not meet their guarantee obligations, but that the GERES management company first renamed itself and then filed for bankruptcy. Thanks to this insolvency at GERES, Mr. W. did not have to contribute to the compensation of the creditors. Complaints about this and other GERES issues also delayed the completion of the insolvency proceedings at Viprinet for years. The creditors had to wait much longer for their money than the insolvency administrator had actually promised them in court. It was not until the beginning of 2017 that the proceedings were finally brought to a conclusion.

Back to growth course

After GERES retired, Viprinet quickly returned to growth. While at the beginning of Viprinet's history, the main selling point was the inexpensive replacement of expensive dedicated lines, this has now changed: more and more data and services have been outsourced to the cloud by companies, including for mission-critical applications. Failures of the connection thus caused companies to lose a lot of money and in some cases even human lives to be at risk. The reliability of Viprinet's products was now in the foreground. Snowden's revelations also made it clear that it is an advantage to have critical network infrastructure built in Germany instead of coming from the US or China.

Foundation of Innovationspark Bingen

Sales grew with the wind

behind them. Soon the space in our office and production rooms

became scarce. In 2014, I took a big step forward: Together with a

partner and supported by the house bank, we bought the 12,000 sqm

former area of Racke in Bingen. This not only gave Viprinet enough

space, but also the option to create a high-tech start-up centre in

the middle Rhine Valley with this company as a "lighthouse". This

was combined with the groundbreaking energy concept developed by us,

which will hopefully be implemented from 2017 onwards. My other

investments in Kissel Ventures GmbH will also be based here in the

future.

Sales grew with the wind

behind them. Soon the space in our office and production rooms

became scarce. In 2014, I took a big step forward: Together with a

partner and supported by the house bank, we bought the 12,000 sqm

former area of Racke in Bingen. This not only gave Viprinet enough

space, but also the option to create a high-tech start-up centre in

the middle Rhine Valley with this company as a "lighthouse". This

was combined with the groundbreaking energy concept developed by us,

which will hopefully be implemented from 2017 onwards. My other

investments in Kissel Ventures GmbH will also be based here in the

future.

We

have only just started out small, and we are converting and

dismantling it step by step under full letting. Currently, a quite

impressive photo studio is being built in a former wine storage

hall, and Viprinet will then move into newly renovated areas within

the site.

We

have only just started out small, and we are converting and

dismantling it step by step under full letting. Currently, a quite

impressive photo studio is being built in a former wine storage

hall, and Viprinet will then move into newly renovated areas within

the site.

In the long term, however, our plans are bigger: the former large-scale winery comprises an extensive building complex between Stefan-George-Straße and Gaustraße. In the coming years, a unique place for working and living is to be created here. In line with the town of Bingen's development plan, the overall concept is based on a general revival of the site and transformation into an "innovation park", the environmental balance sheet of which is to enjoy a unique selling point throughout Germany. However, in order for this to work, we still have to find some co-investors. Details about the project can be found on the Innovation Park website.

Major investments at Viprinet

In 2014, we were fortunately able to win a new partner at Viprinet,

who brought in a large investment. For the first time in Viprinet's

history, we now had the opportunity to make long-term strategic

investments instead of always living from hand to mouth. For two

years we were able to take the time to develop a completely new

generation of products, both in terms of hardware and software -

after 8 years of product maintenance, it was high time for a

"rewrite". We will now reap the fruits of these efforts from 2017

onwards.

In 2014, we were fortunately able to win a new partner at Viprinet,

who brought in a large investment. For the first time in Viprinet's

history, we now had the opportunity to make long-term strategic

investments instead of always living from hand to mouth. For two

years we were able to take the time to develop a completely new

generation of products, both in terms of hardware and software -

after 8 years of product maintenance, it was high time for a

"rewrite". We will now reap the fruits of these efforts from 2017

onwards.

The project to move away from one-off sales as a device manufacturer was really costly. The problem was that our products had always been durable due to their quality and modularity, but this was raised to a new level with the new product generation. How could we live if customers only bought something every 5-10 years, but in between they wanted to get long-term support and firmware updates? Our business model was unsustainable and would eventually kill us. So we had to start focusing on a steady stream of revenue. However, it is extremely difficult to change an existing business model and not to annoy partners and customers. It took us a year of preparation and a lot of persuasion to get it right. However, the consequences were not without consequences: some of the angry partners lost a lot and were unable to record any sales growth in 2016. In the future, sales will flow regularly and permanently in new projects instead of at the beginning of the business relationship - we have therefore adjusted to the fact that it will take a good year for the figures to rise again significantly (but then sustainably).

Investments in

management development have not been 100% successful: After the

company had 50 employees by the end of 2014, too much time went into

managing the operative business instead of being able to focus on

strategy and vision. Now that we had the financial resources to do

so, we decided for the first time in Viprinet's history not to

"breed"our managers ourselves, but to purchase experienced managers.

However, these caused an explosion in our wage costs, and in some

cases did not quite match our corporate culture. In the area of

distribution, employment contracts across national borders also

created a bureaucratic monster. I thought it would be a little too

easy to buy up my skills, and I had gained another experience.

Investments in

management development have not been 100% successful: After the

company had 50 employees by the end of 2014, too much time went into

managing the operative business instead of being able to focus on

strategy and vision. Now that we had the financial resources to do

so, we decided for the first time in Viprinet's history not to

"breed"our managers ourselves, but to purchase experienced managers.

However, these caused an explosion in our wage costs, and in some

cases did not quite match our corporate culture. In the area of

distribution, employment contracts across national borders also

created a bureaucratic monster. I thought it would be a little too

easy to buy up my skills, and I had gained another experience.

All in all, the investment phase from 2014 to 2015 was a good decision, which has brought the company forward. One catch, however, should not go unmentioned: if you invest several million euros in a relatively short period of time, you don't really have to post these investments as expenses and therefore as a loss according to German accounting law. And although we were doing better than ever before as a company, and we had set the right course, our 2015 balance sheet looked as if we had a meteorite set in. German accounting law in combination with a completely nonsensical way of taxing venture capital investments is the reason why in Germany, compared to other Western countries, virtually nothing is invested in venture capital.

Viprinet Americas Inc.

In 2014, I founded Viprinet Americas Inc. in the USA - initially only on paper - and this was followed by Viprinet Americas Inc. One year later, an office followed in Sunnyvale, in the heart of Silicon Valley (directly between Google and Apple).

Anecdote: I thought to myself that Google must surely have Google Fibre (glass fibre) in the immediate vicinity. DSL with a maximum of 1 MBit/s was and is available. As in Bingen, the "Eat your own dogfood"paradigm applies: without our router technology, the office from which we distribute this technology could not be operated at all...

The team consisted of a

technical employee from Germany and one full-time employee from

sales, administration and marketing (which came from the region). In

addition, there was a managing director - a seabeared and very

lovable elderly Danish. The gentleman was a close friend of one of

our associates, and we all trusted him and found him to be extremely

symphatic. We didn't have any trouble trusting him with a lot of our

money.

The team consisted of a

technical employee from Germany and one full-time employee from

sales, administration and marketing (which came from the region). In

addition, there was a managing director - a seabeared and very

lovable elderly Danish. The gentleman was a close friend of one of

our associates, and we all trusted him and found him to be extremely

symphatic. We didn't have any trouble trusting him with a lot of our

money.

Every German company trying to do business in the USA underestimates

the intercultural differences. I was well prepared for them, but in

the end they met us harder than expected. This was clearly evident,

for example, in the area of marketing. When we were preparing our

appearance at the Interop IT fair in Las Vegas, it became clear that

the Americans in the team could hardly laugh at the black humour

spread by Viprinet, while we considered their ideas of what a clever

trade fair concept might look like to be childish and embarrassing.

In the end, I was actually on loan at a trade fair stand with a

James Bond theme. To my complete surprise, it was a great success

and we received many compliments.

It turned out that the manager was trustworthy, but the total miscast. He was too gullible and failed to make contact in Silicon Valley. From a European point of view, he produced gigantic costs for this. And so, after only 12 months, one million euros had already been burned. The sales that had been promised time and again had failed to materialize. However, due to a lack of time and better ideas, we intervened from Germany far too late. When his contract ran out and we didn't want to extend it, he sued us at a Californian labor court: We had discriminated against him because he was Danish.

Grass roots are a good thing

I had already worked on my character traits of the control freak. With my growing need for more self-realization in the area of innovation and vision, I had created a considerable motivation for myself to change even further and to finally be ready to give up comprehensive control. This created the conditions for a gentle path out of the Patriarchate.

From the end of 2015 onwards, I have been promoting, demanding and "empowering" a team of longstanding and successful employees in order to make them fit for the operative management of our company and the replacement of me. At Viprinet in Germany, a group of divisional heads was formed, who, as a working group, were soon able to make decisions together in a well-thought-out and analytical way, without being dominated by a single alpha male. In the USA I let a couple from marketing wife and technician, who had previously sold our products together in the USA as partners, take over the tax.

This time the plan worked. I have achieved a goal that I should have achieved a long time ago: if I were to be run over by the bus tomorrow, it would certainly be a pity, but the company I founded would not have to die as a result. Without wanting to misunderstand this as an appeal to bus drivers to me for violence, I would like to say here that this is now the case. A few years ago, I could hardly have imagined I would have wished for this, but now the time has come: I am no longer irreplaceable.

Today I have a dedicated, loyal and nevertheless emancipated management team at Viprinet, and I am not involved in the operative business. This gave me the freedom to work on further goals.

Outlook

You'll be hearing from me.